Understanding A “Sellers” Market

Covid 19 has had an extreme impact on many areas of our lives and has caused many areas of our economy to falter and some even fail. One area that has thrived throughout most of 2020 and into 2021 is real estate. While there may be other factors that are fueling the housing sellers market boom, the leading factor is near-historic low-interest rates brought about by the Federal Reserve’s effort to prop up our faltering economy.

Like other commodities, the price of housing is influenced in large part by the principle of supply and demand. In Real Estate Agents, when there are more ready, willing, and able buyers than the available supply of housing then the conditions of a seller’s market can be seen.

In general, Buyers have very little leverage in the negotiation process as a common aspect of a seller’s market is multiple offers and the seller can just simply move to the next offer if they are unhappy with the proposed contingencies. Other common aspects that can be seen in a seller’s market are:

- Properties go under contract within hours of being placed on the market

- Properties can go under contract for a price significantly above the asking price brought on by a “bidding war” from prospective buyers.

- Sellers are unlikely to accept contingent offers or offer with a lot of strings attached

- Sellers are unlikely to agree to significant or costly repair requests

- Sellers are unlikely to contribute towards the buyer’s closing or out-of-pocket expenses

You might be saying to yourself that now is not the time to try to purchase your homes available based on the sellers having such an advantage. The 2 important things to keep in mind are that the rates on home loans continue to be very low despite recent increases and there is no way to know how long these rates will last. Secondly, the seller’s market has a very positive impact on the price of housing and once you do own your home you will likely benefit from this increase in equity and start to build wealth through home ownership. The key is to understand what is happening in the market and to follow these easy steps.

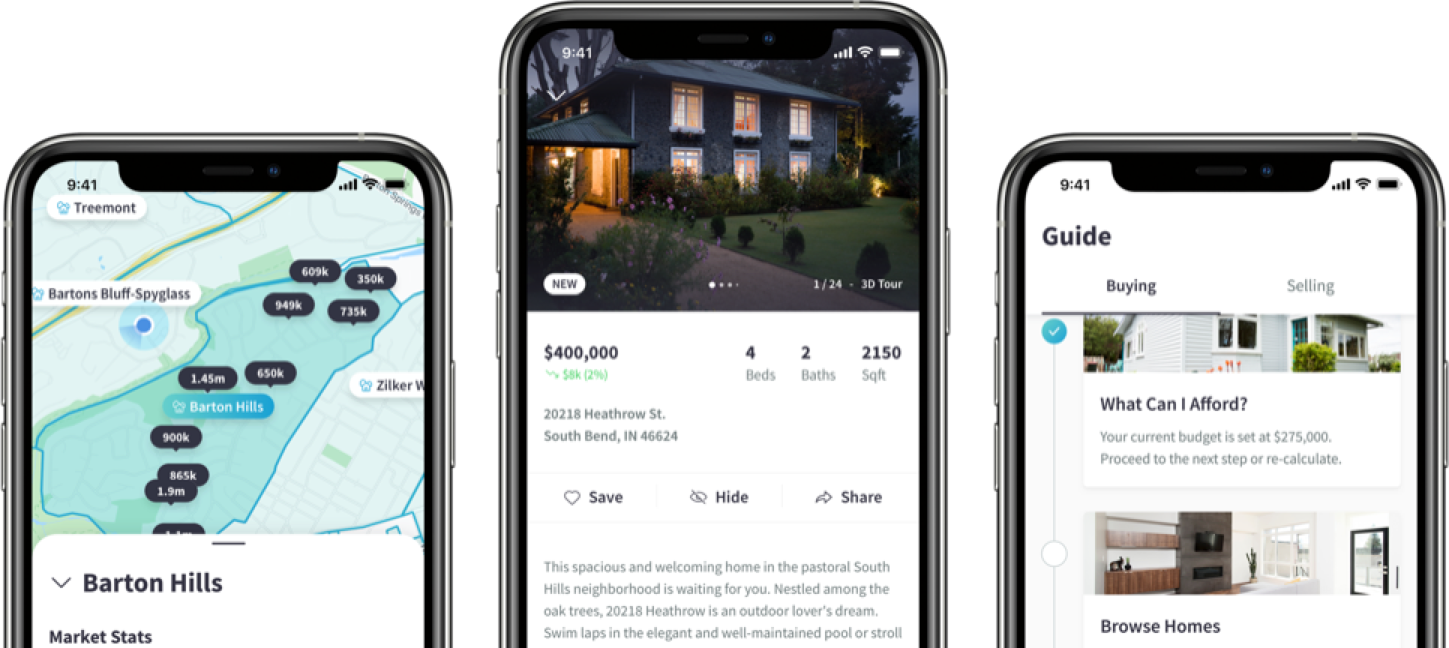

- You need to be represented by a real estate agent. Your real estate agent understands the market conditions, is trained in negotiation tactics, and has access to tools necessary to determine what each property will likely sell for.

- You need to have your financing lined up and ready to go. One key consideration in negotiating is how soon a buyer can close their loan. Make sure you are providing your loan officer all of their required information in a timely manner. Also, some sellers give more weight to different financing options such as Cash, VA, FHA or Conventional when choosing an offer. Make sure you ask your Realtor to explain the pros and cons of each loan type and how that might impact your negotiation power.

- You need to be ready and available to view a property very quickly. As stated above, properties can go under contract within hours so you have to be ready to look when your realtor calls.

- You need to be realistic when determining the price you are offering on a property. Your realtor will use their available resources to determine if the asking price is reasonable price. Offering a price substantially below the asking price is likely not going to result in your end goal of home ownership.

- You need to be realistic about what repairs you request during your due diligence period. Focus on health, safety, and major components like electrical, plumbing, roof, and foundation issues during the inspection period. Cosmetic repair issues are usually minor and repair requests should be held to a minimum.

If the thought of buying a home stresses you out, I encourage you to speak to a real estate professional or take a first-time home buyers class just to learn more. Both are no-cost options to learn more about how home ownership might truly be within your reach. You will be glad you did!