Steps To Buying A Home

Buying a Home might feel like a very complicated process that you don’t even know where to begin. I want to cover the process for you at a pretty high level but You will be working with several different professionals throughout the different 7 steps and they will be responsible for guiding you through the process and ensuring you meet your target of home ownership.

Step 1 – Choose a Mortgage Provider

There are literally hundreds of options when choosing a mortgage provider. Your existing bank might offer mortgages or maybe even the company you have a credit card through. The rule of thumb is to speak to at least 3 different mortgage companies to determine which one fits your needs best. I strongly recommend you speak to at least one local lender who actually lives in or near your community. These professionals have a better understanding of what is happening with the real estate market in your area and also any unique requirements you might experience. An example of that here in Corpus Christi is the requirements to have wind storm coverages and the impact this cost has on your monthly expenses.

Do not worry that all the mortgage companies will pull your credit report as this will not lower your score due to multiple pulls as long as done within 30 days.

Your chosen mortgage provider will work with you to determine the price of house you can afford taking into account the total monthly cost of the mortgage known as P.I.T.I.

P – Principal amount of loan amount paid monthly

I – Interest on the loan that is paid monthly to the mortgage company

T – Estimated amount of property tax expense that is paid monthly but held by mortgage Company until yearly taxes are due and paid on your behalf to Taxing Authorities.

I – Monthly cost of Premium for Home Owners Insurance you have chosen that is held by Mortgage Company and paid on your behalf when yearly premium comes due.

Step 2 – Hire a Realtor

In almost every situation a home buyer pays absolutely nothing to hire a realtor. In the State of Texas, The Seller pays all realtor fees for both the Buyer and the Seller. Despite the seller Paying both commissions, your Realtor works solely for you once you have entered into a Buyers representation agreement . Your Realtor can explain to you the exclusions when you might be asked to pay their commission but again this is rare.

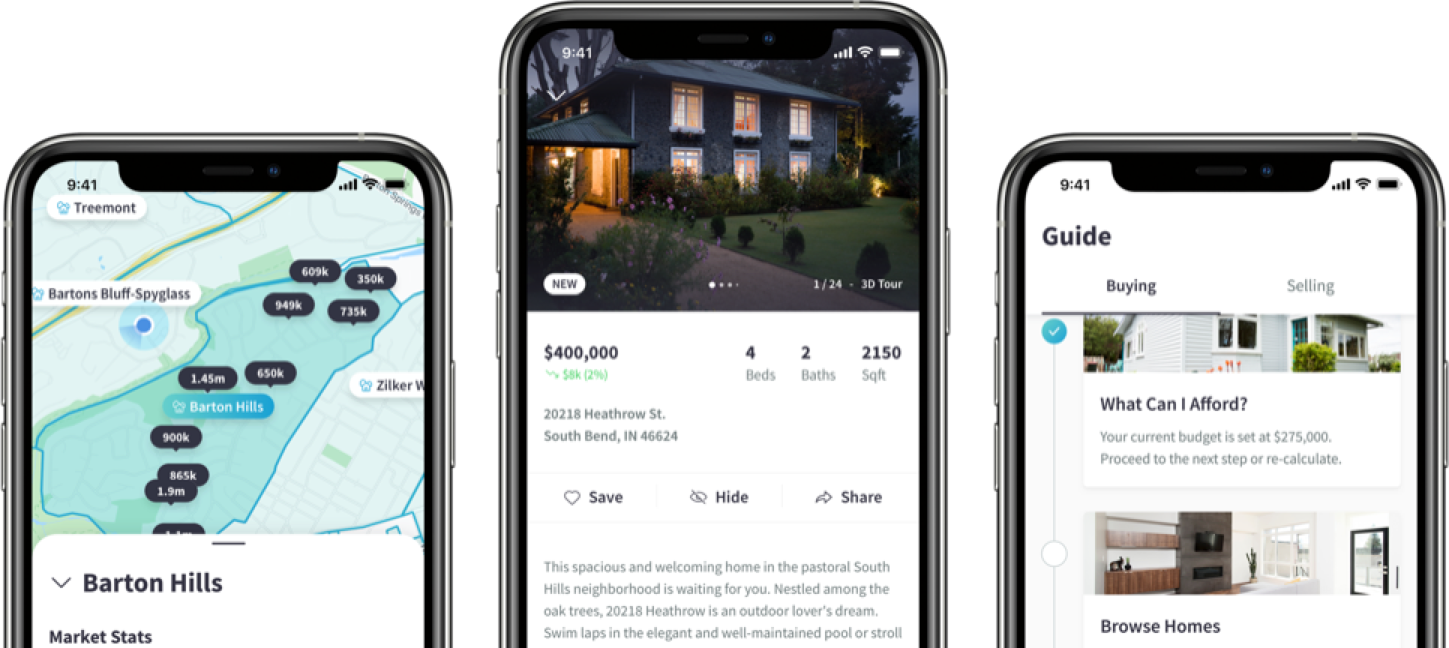

Step 3 – Choose a Home

Your Realtor will meet with you to determine what your requirements are and then begin searching for available properties that closely fit those needs. You need to plan to visit in person every home as you will find that the pictures on line do not always tell the same story.

Step 4 – Make an Offer and Negotiate Contract

Your professional realty group will guide you to a reasonable price to offer on a property using the available tools available to them and then complete the contract. It is not uncommon to have several rounds of negotiations before agreement is met. Once agreed you will pay a small fee to the seller that allows you to conduct due diligence for a specified time period and have the option to terminate the contract without further penalty.

Step 5 – Due Diligence/Option Period

Your Realtor will negotiate as part of the contract a length of time called a due diligence or Option period. During this time, you will schedule inspections and shop for home insurance. If there are issues found during inspections your Realtor will negotiate repairs or you can terminate the contract if the inspection raises concerns or if seller is unwilling to correct them.

Step 6 – Hurry up and Wait

Now that you have completed inspections it will seem that the entire process stalls but that is far from the truth. During this time period, your mortgage lender and the title company are hard at work.

Lender – Now that you have chosen your specific home, your mortgage company can now go to work finalizing your loan and making sure that the house is worth the amount that you are wanting to pay thru the Appraisal process. This is important to the bank in case of default. They want to make sure that the amount they are loaning to you will be protected should the Buyer default on the loan.

Title – The title company is responsible to make sure that no one else has a legal claim to own your property or that there are no liens that you might be responsible for. In Texas, they are also responsible to collecting all the needed documents to close the loan and ensuring those documents are filled out correctly and then filed with the proper authorities.

Step 7 – Closing

Generally, you will visit your local Title Company to sign all of the legal documents required. Once signed, your title company will notify the mortgage company to fund the loan. Note, in most cases, you will not receive the keys to your new home until the money is received which can take several hours, and depending on what time of day you close it might delay funding until the next day.

Let Coastal Living Realty Group Help You!

If the thought of buying a home stresses you out, I encourage you to speak to a real estate professional or take a first-time home buyers class just to learn more. Both are no-cost options to learn more about how homeownership might truly be within your reach. You will be glad you did!